News

Fall Festivities and Socializing- Safely.

Socializing is critical for mental health, and people who associate with others live longer. Research also concludes that isolation can often lead to loneliness, depression, and other health problems. Especially now, during COVID-19, our desire to connect with others is heightened. Before the fall season changes to winter and cold weather arrives, get out and enjoy the season- but do

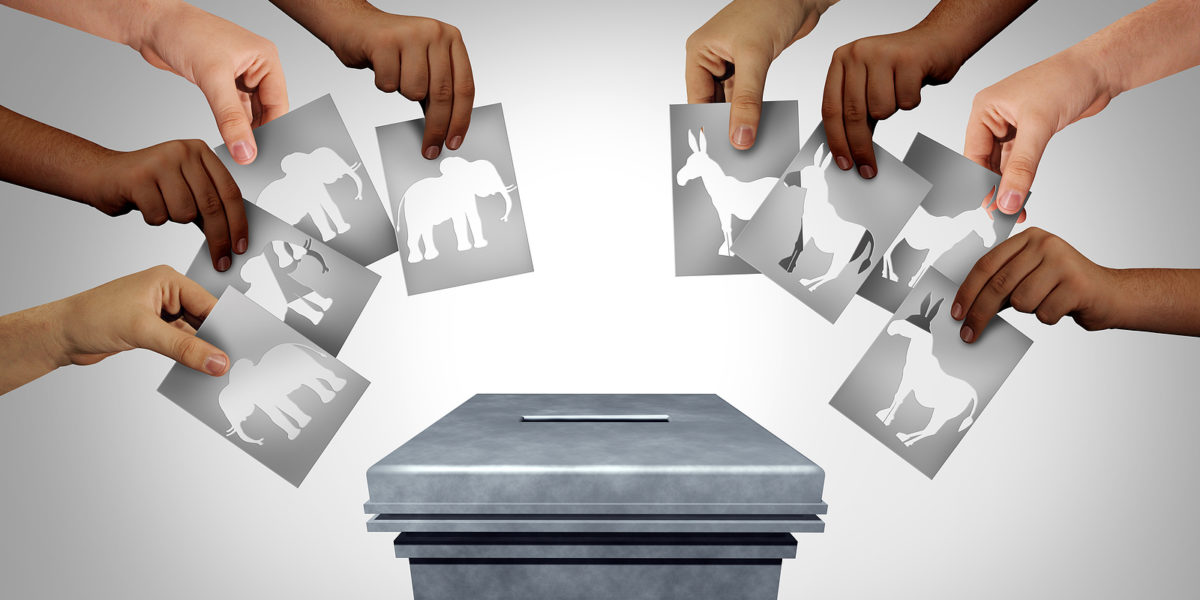

The 2020 Election: Check Your Emotions and Stay Invested

November third is fast approaching, and you may be wondering how the 2020 Presidential election might impact your portfolio. Here is what we know from a historical perspective:

Now is the Time to Schedule Your Fall Financial Review

October is the financial planning month and a great time to meet with your financial professional to ask questions, review policy and portfolio performance, and make decisions that keep you on track with your goals. Regardless of your age, it may be a suitable time for you to schedule a financial review.

Lowering Interest Rates: Good for the Economy and the Markets?

Interest rates can positively or negatively affect the U.S. economy, the stock markets, and your investments. When the Fed changes the Federal Funds Rate (the rate at which banks can borrow money to lend to businesses or you), it creates a ripple effect. In this article we take a look at how lowering the interest rate can impact you.

What Does Wealth Mean to You?

When people think of wealth, they might think of examples in film, such as Veruca Salt from the 1971 classic Charlie & the Chocolate Factory. Little Veruca had everything she wanted in life but desired one of Willy Wonka’s geese that laid golden eggs. When Wonka refused to sell the little girl’s father one of his prized fowls, the girl

Life Insurance as Unique as You

Your life insurance needs are unique to your situation and can change over your lifetime. For some people, life insurance is to provide assets to raise a young family in the event of early death. Other people may use life insurance to cover their debt to ensure it is taken care of if they die prematurely. In business, life insurance

Reg BI: What Is It, and Why Should You Care?

On June 30, 2020, Regulation Best Interest, or Reg BI for short, officially went into effect. But what is Reg BI, exactly? Where did it come from, and how does it impact you, the investor? Here’s what to know about the new rule under the Securities and Exchange Commission (SEC).

The CARES Act and RMD: Relief for Investors

YOu The CARES Act (The Coronavirus Aid, Relief, and Economic Security Act) contains the legislation for Required Minimum Distributions (RMD) for those over age 70 ½ and have already started RMD. Under the CARES Act, no RMD is required for individuals or beneficiaries of inherited retirement accounts in 2020 due to COVID-19. How will this help investors?

The Upside of the COVID-19 Pandemic

The COVID-19 pandemic has pulled the rug out from under just about everyone on every continent. This pandemic has understandably had a dramatic effect on the everyday lives of most people across the globe. With stay-at-home orders to work remote and children distance-learning this past school year and possibly this fall, many cannot wait for 2020 to be over.

Investment Risk During and After COVID-19

Investment risk is always present, but during COVID-19, the stock market has experienced so much volatility that investors are beginning to wonder where to invest. Investors must consider how investment risk can decline their portfolio’s value due to economic events that impact the entire stock market.